Major Positive News | Kudi's second factory introduces financing and leasing services to help SMEs upgrade equipment

Introduction:

The pervasive epidemic has caused instability and market shrinkage. This special period is both a crisis and an opportunity.

The market landscape is changing, and industry reshuffling is accelerating. Many visionary companies are strategically positioning themselves by deploying more advanced and high-end equipment to enhance their competitiveness and strive for success in the future market.

However, with increasingly tight cash flow, how should the upgrading and replacement of production equipment be operated and implemented?

Kudi Second Machine and Far East Macro Holdings PuHui Leasing (Tianjin) Co., Ltd. (hereinafter referred to as "PuHui Leasing") have formed a strategic partnership, leveraging the resources of industry and finance to achieve complementary advantages and help small and micro-enterprises accelerate equipment upgrades and maintain technological leadership.

Introduction to PuHui Leasing

PuHui Leasing is affiliated with Far East Macro Holdings Co., Ltd., with a registered capital of 2 billion yuan.

Far East Macro Holdings, with a pure central enterprise background, is one of the earliest leasing companies in China and the first leasing company to be listed. It has now entered the Fortune China 500 and Forbes Global 2000.

PuHui Leasing leverages the advantages of Far East Macro Holdings' scale and professionalism in financing leasing, focusing on serving small and medium-sized enterprises and specializing in financing leasing business.

What is financing leasing?

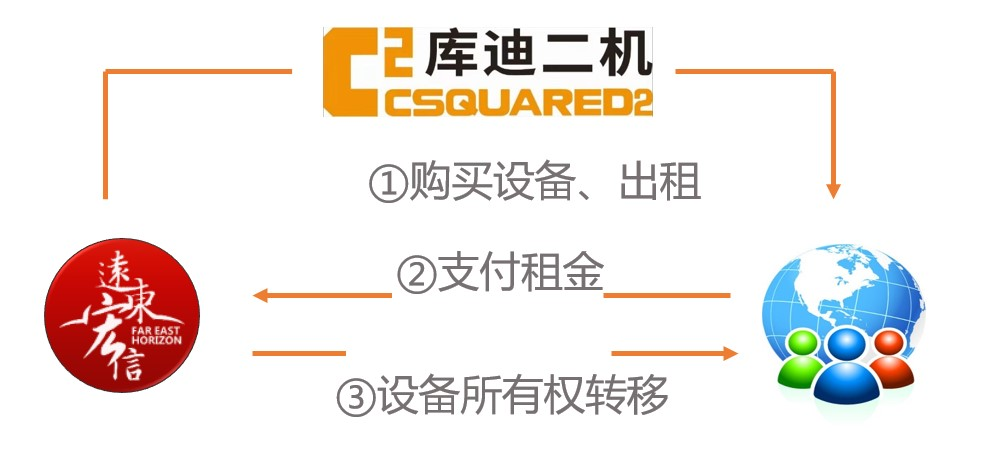

Kudi Second Machine and Far East PuHui jointly launched a purchase loan, specifically serving Kudi Second Machine's customer base. Far East PuHui purchases equipment from Kudi Second Machine according to the enterprise's requirements, the enterprise uses the equipment and pays the rent on time, and the enterprise obtains ownership of the equipment after the lease expires.

Why should enterprises choose financing leasing?

Currently, the state and local governments are advocating and supporting enterprises, especially small and micro-enterprises, to update their equipment through financing leasing. Taking Foshan City as an example, the government has officially issued a document providing local enterprises that update equipment through direct leasing with an annual subsidy of 5%, which is equivalent to interest-free installments!

Similar preferential policies have also been introduced in other provinces and regions. Government policies provide a rare opportunity for enterprises to achieve their own leapfrog development.

Which equipment of Kudi Second Machine can use financing leasing?

Kudi Second Machine's laser cutting machines, laser continuous blanking lines, and other laser equipment can all be purchased through financing leasing.

For equipment with a value not exceeding 2 million yuan, the basic approval requirements are:

1. The enterprise has been established for more than 1 year;

2. No adverse credit record or litigation record.

For equipment with a value not exceeding For equipment with a value of 15 million yuan, the basic approval requirements are:

1. The enterprise has been established for more than 2 years;

2. No adverse credit record or litigation record.

Must enterprises choose the financing services provided by PuHui Leasing?

Not necessarily. Enterprises can also independently choose their familiar financing leasing companies, and after the three parties reach a consensus, sign a cooperation agreement.

What documents are needed to handle financing leasing business?

1. Enterprise certificate

2. Identity certificate of the actual controller

3. Credit authorization

4. Equipment purchase contract

What is the down payment ratio for purchasing equipment through financing leasing?

10%~30% of the equipment cost. This low down payment can effectively alleviate the pressure on enterprises, allowing enterprises to use advanced technology equipment with less investment, enhancing the sustainable development capabilities of enterprises.

How long is the business approval cycle?

The approval time for complete documents is 3 working days, and it takes 2-3 weeks from approval to disbursement.

How long is the financing cycle for financing leasing?

The financing cycle is agreed upon according to the actual needs of the enterprise, and the longest can be up to 3.5 years.

What is the process of financing leasing?

RELATED POSTS

Flash | Kudi's second plant becomes a council member of Guangdong Laser Industry Association